The Venezuelan inflation rate puzzle

Last week, Central Bank of Venezuela, released the inflation rate results for the first quarter. According to the national consumer price index variations, accumulated inflation for the first three months of the current year achieved only 5.8% and on a year over year basis, the number was 26.2%.

Even though Venezuelan inflation rate is quite high for international standards, first quarter results are much lower than consensus expectations. In fact, based on the historically pass-through effect and after January devaluation of 60%, many analysts expected a much faster path of growth for consumer prices.

Apparently price controls could avoid higher pass-trough effects. But I do not find this a satisfactory answer for at least two reasons. Firstly, core inflation has not accelerated since January. If price controls are the main reason behind the lag in inflation, core inflation which explicitly excludes price control and seasonal effects, had grown significantly. However, core inflation is pretty much the same in March (30.2%) on an annual basis in comparison with January (29.8%)

Secondly, if price controls were an effective barrier against the inflationary consequences of devaluations then a “new inflation” associated with the new exchange rate can be only identified at the wholesale level.

Nonetheless, wholesale import index does not indicate a significant change on the first quarter of the year. Even the total wholesale index (adding domestic and imported goods) neither indicates meaningful inflation acceleration since January.

Originally question resurges, if price controls are not the driver of a lower than expected inflation, what is the main factor behind the inflation numbers?

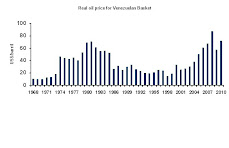

A possible explanation is that pass-through effect is currently lower in comparison to other devaluation years because of the extensive period of exchange rate control (seven years) and due to the extensive use of the parallel exchange rate as a price set up. This argument states that prices were already fixed taking into account parallel market exchange rate which reduced the direct effect of the official devaluation on domestic prices.

However, as inflation rate in 2009 was also lower than expected (25.1%) a year in which parallel market rate gained influence on domestic price setting, my guess is that the main driver of the current inflation numbers is that our economy continues in a recession which means that aggregate demand keeps decreasing. As I posted last week, several leading indicators suggest that on the first three months, Venezuelan economy could have registered the worst growth numbers since 2002-2003.

A combination of power shortage and regional compulsory cuts and a significant drop in private investment are the main drivers of the current recession and therefore also the main explanatory factors behind the first quarter inflation numbers.

Last week, Central Bank of Venezuela, released the inflation rate results for the first quarter. According to the national consumer price index variations, accumulated inflation for the first three months of the current year achieved only 5.8% and on a year over year basis, the number was 26.2%.

Even though Venezuelan inflation rate is quite high for international standards, first quarter results are much lower than consensus expectations. In fact, based on the historically pass-through effect and after January devaluation of 60%, many analysts expected a much faster path of growth for consumer prices.

Apparently price controls could avoid higher pass-trough effects. But I do not find this a satisfactory answer for at least two reasons. Firstly, core inflation has not accelerated since January. If price controls are the main reason behind the lag in inflation, core inflation which explicitly excludes price control and seasonal effects, had grown significantly. However, core inflation is pretty much the same in March (30.2%) on an annual basis in comparison with January (29.8%)

Secondly, if price controls were an effective barrier against the inflationary consequences of devaluations then a “new inflation” associated with the new exchange rate can be only identified at the wholesale level.

Nonetheless, wholesale import index does not indicate a significant change on the first quarter of the year. Even the total wholesale index (adding domestic and imported goods) neither indicates meaningful inflation acceleration since January.

Originally question resurges, if price controls are not the driver of a lower than expected inflation, what is the main factor behind the inflation numbers?

A possible explanation is that pass-through effect is currently lower in comparison to other devaluation years because of the extensive period of exchange rate control (seven years) and due to the extensive use of the parallel exchange rate as a price set up. This argument states that prices were already fixed taking into account parallel market exchange rate which reduced the direct effect of the official devaluation on domestic prices.

However, as inflation rate in 2009 was also lower than expected (25.1%) a year in which parallel market rate gained influence on domestic price setting, my guess is that the main driver of the current inflation numbers is that our economy continues in a recession which means that aggregate demand keeps decreasing. As I posted last week, several leading indicators suggest that on the first three months, Venezuelan economy could have registered the worst growth numbers since 2002-2003.

A combination of power shortage and regional compulsory cuts and a significant drop in private investment are the main drivers of the current recession and therefore also the main explanatory factors behind the first quarter inflation numbers.

No comments:

Post a Comment