First Quarter of 2010. Preliminary comments

1. Current Context

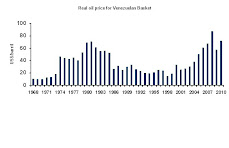

After four years of strong numbers of economic growth associated with high oil prices, during the third quarter of 2009, Venezuelan economy officially entered into a recession. According to the Central Bank of Venezuela (BCV), our GDP registered a cut of 3.3% for the year as a whole and on a quarterly basis; for the last three months of 2009, BCV estimated a drop around 5.8%

In addition to the 2009 economic growth results, this year began with 60% of currency devaluation, a non-expected and severe power crisis and the aftermath of the private but Government-related banks crisis developed in the end 2009. Therefore, consensus among main economists, moved from a likely but modest recovery scenario for 2010 to a very probably second in a row year into a recession.

A couple of important facts increased the recession odds for 2010. On the Government side, the resign of the former Vice-President Ramón Carrizales, mean a return to inside administrative problems and added new temporal barriers in order to transform official announcements of more fiscal expenditure into real and effective transfers of resources to regions, paying domestic debt to Government suppliers and monitoring new state enterprises performance.

Due to the fact that Carrizales was a sort of a former “General or Chief Administrative Manager” who was in charge to deal with foreign and expropriated firms and occasionally was in charge to lead the Ministry Council (The maximum coordination mechanism inside the Executive Branch), the arrival of a new Vice-President will require a couple of months in order to complete the learning process and deal with all the administrative issues under his control and return to a normal working of the public administration.

On the other hand, during the first quarter of 2010, several microeconomics and regulatory problems surged in most of the productive sectors, especially in those sectors subject to price controls. In particular, labor conflicts, scarcity of imported inputs, long delays in adjustments of price control goods and the spread out of expropriations, have had a negatively impact on investment sentiment.

2. First Quarter Outlook

Nonetheless, statistical numbers about first quarter are not available yet, some leading indicators could help to address the current macroeconomic situation. In particular we are going to use the monetary supply numbers, the imports coming from Brazil and the United States, the unemployment data and the inflation results, in order to do a reasonable estimation about first quarter results.

2.1 Monetary supply.

As we can see from figure 1, estimated cut for real monetary supply during the first quarter of the year is around 6%. Real monetary reduction is responding to a lower demand for loans in a context of negative investment expectations, vehicle industry crisis and a cut in the household income. As real monetary supply is usually the best leading indicator for the Venezuelan economy, first three months performance of monetary liquidity would indicate that recession will extend for at least the first two quarters of this year.

2.2 Imports coming from Brazil and the United States

Venezuelan imports historically highly respond to national income. Therefore, an indirect way so see what is going on with the state of the economy can be found, just studying the imports performance coming from the main trade partners. Looking at the numbers of imports, we find a significant cut of Venezuelan external purchases. For instance, with the United States, January imports decreased more than 29 % in year over year basis and in regards to Brazil, annual growth for the first two months was -21% and -11% respectively.

2.3 Unemployment data.

For the first time in the last three years, total unemployment number is higher during January and February in comparison with the same months a year earlier. Actually, total non-employees grew by around 138,000 and 190,000 respectively in the first two months of the year. Unemployment results, suggest that economy keeps falling down during the first quarter of the year.

2.4 Inflation results.

On the inflation side, although inflation rate remains high, it is actually quite lower than the economists forecast immediately after the January currency devaluation. Historically, pass-through effect in Venezuela (Inflation caused directly by devaluation) is around 66%. As we observed 60% devaluation in January, originally inflation expectations were around 40%.

However, on a year/year basis, inflation still remains around 25% but is highly influenced by food price controls. Actually if we take into account only the goods that are not subject to price controls, this is core inflation, the number would be 33%. The gap between initial inflation expectation and current results -including core inflation- suggest that the recession period could be longer and greater.

3. Final Remarks

Leading and contemporaneous indicators, suggest that the recession period will extend for at least two or even more quarters. Without available information for the oil production, but based on the performance of imports from selective trade partners, the real monetary supply behavior, the unemployment data and the inflations results, we state that economy fell down by around 6% during the first quarter of 2010

1. Current Context

After four years of strong numbers of economic growth associated with high oil prices, during the third quarter of 2009, Venezuelan economy officially entered into a recession. According to the Central Bank of Venezuela (BCV), our GDP registered a cut of 3.3% for the year as a whole and on a quarterly basis; for the last three months of 2009, BCV estimated a drop around 5.8%

In addition to the 2009 economic growth results, this year began with 60% of currency devaluation, a non-expected and severe power crisis and the aftermath of the private but Government-related banks crisis developed in the end 2009. Therefore, consensus among main economists, moved from a likely but modest recovery scenario for 2010 to a very probably second in a row year into a recession.

A couple of important facts increased the recession odds for 2010. On the Government side, the resign of the former Vice-President Ramón Carrizales, mean a return to inside administrative problems and added new temporal barriers in order to transform official announcements of more fiscal expenditure into real and effective transfers of resources to regions, paying domestic debt to Government suppliers and monitoring new state enterprises performance.

Due to the fact that Carrizales was a sort of a former “General or Chief Administrative Manager” who was in charge to deal with foreign and expropriated firms and occasionally was in charge to lead the Ministry Council (The maximum coordination mechanism inside the Executive Branch), the arrival of a new Vice-President will require a couple of months in order to complete the learning process and deal with all the administrative issues under his control and return to a normal working of the public administration.

On the other hand, during the first quarter of 2010, several microeconomics and regulatory problems surged in most of the productive sectors, especially in those sectors subject to price controls. In particular, labor conflicts, scarcity of imported inputs, long delays in adjustments of price control goods and the spread out of expropriations, have had a negatively impact on investment sentiment.

2. First Quarter Outlook

Nonetheless, statistical numbers about first quarter are not available yet, some leading indicators could help to address the current macroeconomic situation. In particular we are going to use the monetary supply numbers, the imports coming from Brazil and the United States, the unemployment data and the inflation results, in order to do a reasonable estimation about first quarter results.

2.1 Monetary supply.

As we can see from figure 1, estimated cut for real monetary supply during the first quarter of the year is around 6%. Real monetary reduction is responding to a lower demand for loans in a context of negative investment expectations, vehicle industry crisis and a cut in the household income. As real monetary supply is usually the best leading indicator for the Venezuelan economy, first three months performance of monetary liquidity would indicate that recession will extend for at least the first two quarters of this year.

2.2 Imports coming from Brazil and the United States

Venezuelan imports historically highly respond to national income. Therefore, an indirect way so see what is going on with the state of the economy can be found, just studying the imports performance coming from the main trade partners. Looking at the numbers of imports, we find a significant cut of Venezuelan external purchases. For instance, with the United States, January imports decreased more than 29 % in year over year basis and in regards to Brazil, annual growth for the first two months was -21% and -11% respectively.

2.3 Unemployment data.

For the first time in the last three years, total unemployment number is higher during January and February in comparison with the same months a year earlier. Actually, total non-employees grew by around 138,000 and 190,000 respectively in the first two months of the year. Unemployment results, suggest that economy keeps falling down during the first quarter of the year.

2.4 Inflation results.

On the inflation side, although inflation rate remains high, it is actually quite lower than the economists forecast immediately after the January currency devaluation. Historically, pass-through effect in Venezuela (Inflation caused directly by devaluation) is around 66%. As we observed 60% devaluation in January, originally inflation expectations were around 40%.

However, on a year/year basis, inflation still remains around 25% but is highly influenced by food price controls. Actually if we take into account only the goods that are not subject to price controls, this is core inflation, the number would be 33%. The gap between initial inflation expectation and current results -including core inflation- suggest that the recession period could be longer and greater.

3. Final Remarks

Leading and contemporaneous indicators, suggest that the recession period will extend for at least two or even more quarters. Without available information for the oil production, but based on the performance of imports from selective trade partners, the real monetary supply behavior, the unemployment data and the inflations results, we state that economy fell down by around 6% during the first quarter of 2010

1 comment:

Great Blog my friend, I have not read such as deep analysis about current, and forecast situation of our unlucky country.

Regards

Your friend..Jose Maria Gonzalez

Post a Comment